Solvency reserve accounts missing from Manitoba’s new pension amendments

By Julius Melnitzer | October 20, 2021 Although Manitoba’s Pension Amendments Act takes effect on Oct. 1, pension plan sponsors are disappointed that the provisions allowing them to use reserve accounts to fund solvency deficiencies have been excluded from the proclamation. “The government has not indicated when the reserve account provisions will come into effect […]

Ontario court upholds employees’ right to sue for wrongful dismissal in cases of chronic stress

By Julius Melnitzer | September 17, 2021 Ontario’s Divisional Court has affirmed employees’ right to sue for wrongful and constructive dismissal in the civil courts in cases of chronic mental stress arising from workplace harassment. “That’s important because workplace compensation claims by employees suffering from mental stress as a result of harassment might increase an […]

Violating property maintenance, safety and sanitation laws in Quebec: beware the consequences

September 17, 2021 By Aubie J. Herscovitch and Alexander Rigante, guest contributors This article examines the rules and regulations regarding the maintenance, safety and sanitation of buildings in Quebec, with emphasis on the penalties and powers of which municipal authorities can avail themselves should a property owner fail to maintain these standards. According to the Loi […]

Rising municipality charges stalling efforts to develop green buildings in Canada

The Hastings-Quinte Social Services committee announced Wednesday that five retirement complex buildings in Belleville will have solar panels installed on their rooftops, like here at The Prince William building. PHOTO BY POSTMEDIA FILES By Julius Melnitzer | September 8, 2021 Rising development charges and insufficient incentives are stifling some major municipalities’ efforts to encourage developers […]

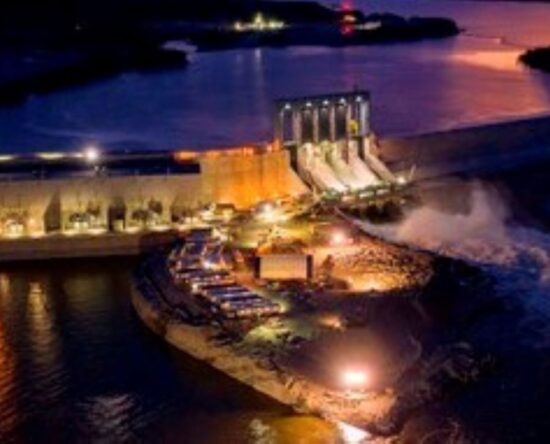

Ottawa’s Muskrat Falls bailout triggers First Nations lawsuit

Given the number of natural resource projects that have Indigenous support, this type of litigation could become more frequent A pair of disputes in Newfoundland and Labrador and Alberta relating to resource projects on Indigenous territory, suggests that federal and provincial governments still don’t get it when it comes to their well-established duty to consult […]

Court of Appeal decision highlights importance of clear pension communications

By Julius Melnitzer | August 13, 2021 A recent Saskatchewan Court of Appeal decision illustrates the importance of clear communications from pension administrators seeking to avoid liability from lawsuits by claimants alleging they’re entitled to a plan member’s death benefits. “What it comes down to is that employers and pension plans that want to avoid […]

Shell-shocked: Could a Dutch court’s ruling on Shell’s emissions encourage similar cases in Canada?

‘It’s a decision that’s worth paying attention to, and that people are talking about’ By Julius Melnitzer | August 11, 2021 If there’s any doubt about the extent to which societal and legal expectations regarding climate change are evolving, a Netherlands court’s ruling ordering Royal Dutch Shell Plc. to reduce the CO2 emissions of its 1,100 companies […]

B.C. court ruling could mean First Nations consent needed for any new project on historic treaty lands

Ruling dramatically lowers the bar for First Nations to demonstrate their treaty rights have been infringed By Julius Melnitzer | July 28, 2021 A British Columbia Supreme Court decision requiring the provincial government to consider the “cumulative effects” of development could mandate First Nations’ consent for any new project on historic treaty lands in Canada. […]

Recommended Reading: Timely Law Firm Bulletins

By Julius Melnitzer | July 19, 2021 CHARITIES & NON-PROFIT Miller Thomson: Why it matters that the Supreme Court decision reinforced the existence of hidden contracts in charity/nonprofit governance COMPETITION McMillan: Emerging Competition & Data Privacy Issues for Real Estate Organizations DATA PRIVACY Gowlings: New Standard Contractual Clauses for International Transfers Under The GDPR McCarthy […]

Little legal clarity for employers dealing with pandemic-related layoffs

By Julius Melnitzer | July 18, 2021 A trio of conflicting decisions from Ontario’s Superior Court of Justice has left employers confused about a possible onslaught of wrongful dismissal lawsuits stemming from temporary layoffs due to the coronavirus pandemic. The confusion arises because judges have come to different conclusions about Ontario’s infectious disease emergency leave regulation, […]